Average Irish beef farm income to reach €25,000 this year

Average farm incomes on Irish beef farms is forecast to reach €25,000 in 2025, a sharp increase on previous years, according to a new report.

The Teagasc Outlook 2025 farm income report estimates that the average income for cattle rearing farms is forecast to be €25,000 in 2025, up 85% on last year (€13,547).

While cattle other (primarily finishing) farms are expected to see incomes rise by 44% to €26,000. (2024: €18,101).

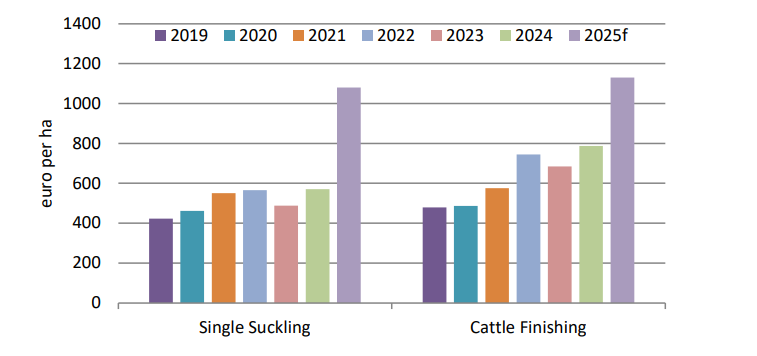

The average gross margin on a single suckling enterprise is expected to increase by 90% to €1,080/ha in 2025.

While the average gross margin on cattle finishing enterprises is due to increase by 44% to €1,130/ha this year.

The report finds that the average net margin per hectare is forecast to reach €550/ha on both beef systems in 2025.

Teagasc economists said that EU beef supply is expected to drop by 2.5-3% in 2025, when compared to last year's levels.

EU exports are expected to decrease slightly this year and imports of beef are expected to be similar to 2024.

For the year as a whole, UK beef production is expected to be 6% lower in 2025, compared to last year.

Overall consumer spending on beef is due to be higher in both the UK and the EU, as rising consumer prices offset declines in the volume of consumption.

Teagasc said that the drop in beef production is stronger than the underlying decrease in consumer demand, which is resulting in higher farmgate prices.

In the first six months of 2025 (H1), Irish finished cattle prices were 34% higher than in H1 2024.

The annual average Irish finished cattle price is forecast to be 38% higher in 2025 relative to 2024. Weanling and store prices are forecast to increase by 45% on last year.

Live cattle prices will be supported in the short-term by a decline in beef production in key EU markets and a slightly lower UK beef supply.

Irish steer beef production is forecast to be 2% lower overall in 2025 compared to last year.

Average weights of finished cattle are stable in 2025 relative to 2024, the report said.

Teagasc said that a decrease in cow slaughter (mainly dairy cows) is forecast to lead to a 1% decrease in total beef production.

The total costs of production on single suckling and cattle finishing enterprises are forecast to be 1% higher in 2025 relative to 2024.

Direct costs are forecast to be 3% higher on single suckling enterprises and 1% higher for cattle finishing systems compared to last year.

The report adds that overhead costs are forecast to be similar to 2024 levels.