Beef carcass price in January '25 up 18% compared to '24

EU and UK, beef production remained strong going into the third quarter of 2024, up 3.6% for the period January through October 2024.

Both higher slaughter and increased slaughter weight (+1% YTD) contributed to the increase, according to the latest research from Rabobank.

Beef production in France remained stable (-0.1% YTD) while other large beef-producing countries saw production expanding, such as Ireland (+ 1% YTD), Germany (+2.2% YTD), Spain (+3.4% YTD), Italy (+7.1% YTD) and the UK (+4.1% YTD).

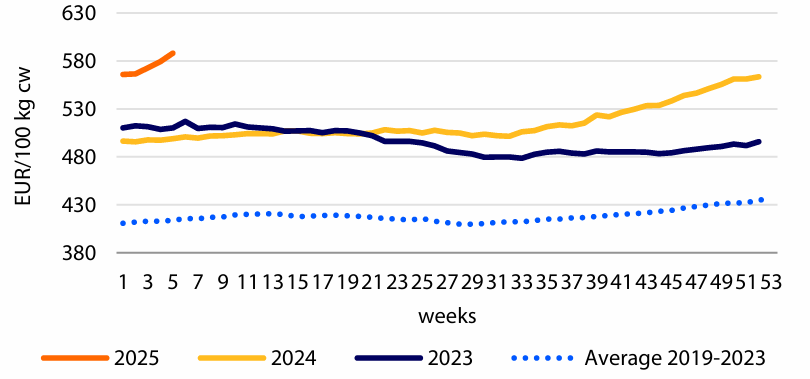

Despite higher production throughout 2024, markets remained tight, which boosted beef carcass prices in January 2025.

In week 5, 2025 the average beef carcass price in the EU was up by 4% compared to the last week of 2024 and up by 18% compared to the same period last year.

RaboResearch said it expects European beef production to remain restricted in 2025 down by 1% year-on-year, supporting upward price pressure.

EU and UK beef imports increased 7.5% for the period January through November 2024 compared to 2023 levels.

Meanwhile, EU and UK exports were up by 22% in the same period, driven by increases to Turkey, Algeria, Canada and the Philippines.

Live cattle (including cattle for breeding) exports from the EU27 (member states) declined by 15% (50,000 metric tonnes) in the period January through October 2024.

Live cattle exports to Turkey dropped to zero as the country imported higher volumes of beef, although the number of cattle for breeding increased by 28%.

Live exports to Algeria also fall by 86% driven by a decline in both live cattle and cattle for breeding.

A foot-and-mouth outbreak in three water buffalo in Germany on January 10, 2025 resulted in import restrictions being imposed by EU external trading partners (e.g by the UK) for beef, among other livestock products.

The impact is expected to be limited as Germany can continue such exports within the EU accounting for 90% of total German beef exports according to the regionalisation principle.

However, the country has lost access to the UK market, its largest non-EU market, representing about 2% of total German exports for this type of meat, (5,000mt in 2023).