Beef kill: Factory supply firm despite 8% drop forecast for Q1

Supplies of factory cattle to-date this year are remaining relatively on par with last year's numbers, latest beef kill figures from the Department of Agriculture, Food and the Marine (DAFM) show.

Just over 206,000 head of cattle have been slaughtered at DAFM-approved factories to-date this year as of Sunday, February 9. This figure is down by less than 1,000 head from the total number of cattle that were slaughtered in the same time period in 2024.

The cumulative supply of young bulls, heifers, and steers (bullocks) is up compared to last year, while the cow kill figures are down by almost 6,000 head.

The table below details the beef kill composition for the week ending, Sunday, February 9, versus the same week of last year, as well as the cumulative beef kill this year versus last year:

| Type | Week ending Sun, Feb 9 | Equivalent Last Year | Cumulative 2025 | Cumulative 2024 |

|---|---|---|---|---|

| Young Bulls | 3,050 | 2,510 | 19,281 | 18,392 |

| Bulls | 410 | 344 | 1,844 | 1,955 |

| Steers | 11,750 | 11,389 | 70,290 | 69,879 |

| Cows | 8,479 | 9,235 | 46,987 | 53,823 |

| Heifers | 11,163 | 10,003 | 67,945 | 63,064 |

| Total | 34,852 | 33,481 | 206,347 | 207,113 |

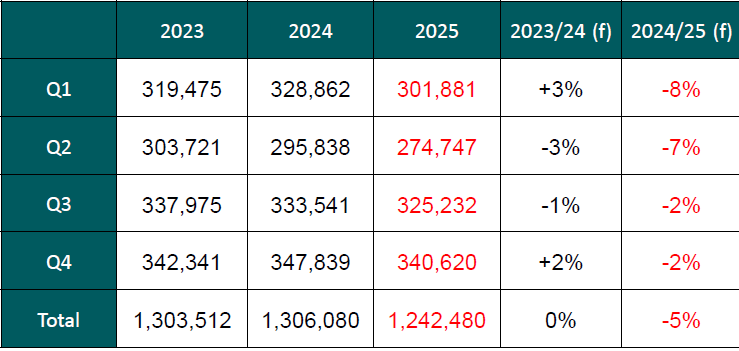

These solid supplies are materialising despite projections from Bord Bia of an 8% drop in cattle supplies from January-March (Q1) of 2025.

Bord Bia has also forecast a 7% drop in factory cattle supplies from April-June (Q2) followed by a 2% drop in supplies for July-September (Q3) and October-December (Q4) of this year.

The table below details the forecasted 2025 beef supply for each of the four quarters of the year, compared to 2023 and 2024:

The record beef prices currently on offer and an uplift of over €1/kg in beef prices in the past three months are likely contributing to more farmers pushing cattle for an earlier slaughter date to avail of the current strong trade.

This will likely result in less cattle available later in the year than was originally forecast.