Beef kill: Shortage of factory cattle becomes more apparent

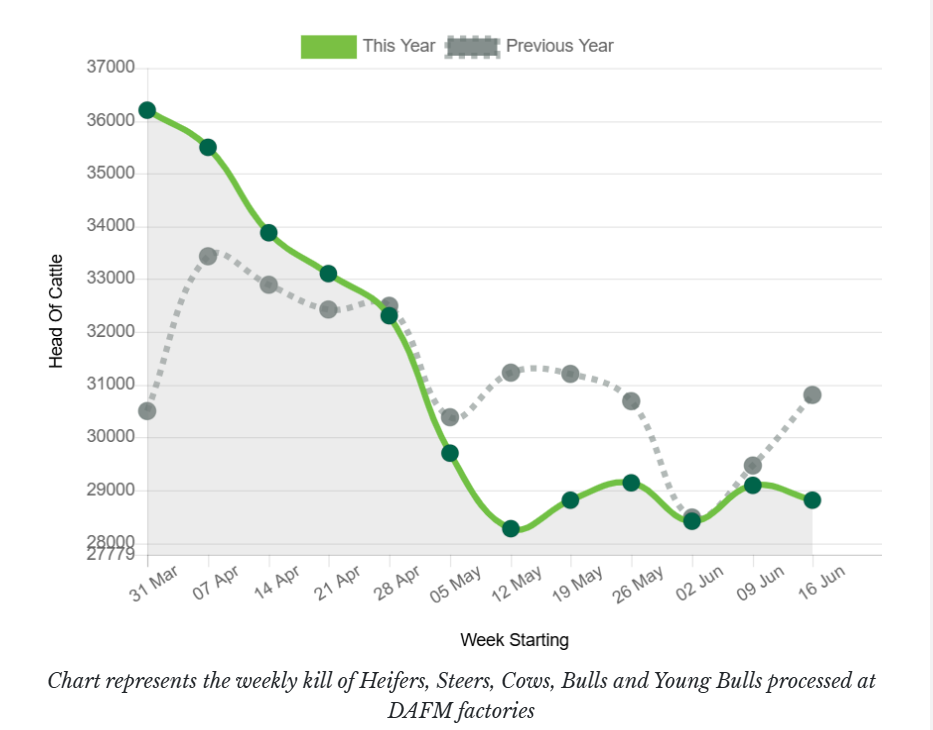

The past eight consecutive weeks have seen weekly beef kill numbers remain below the corresponding weeks of 2024 as the forecasted drop off in factory cattle supplies becomes more apparent.

Weekly kill numbers have failed to surpass 30,000 head since the end of April but, in the same time last year, surpassed this figure for five weeks from April to mid-June 2024.

Supplies had been ahead of forecast for the first four months of the year but recent factory cattle supply data shows the drop-off in supply is now starting to materialise.

The graph below shows how weekly beef kill numbers this year have been comparing to last year:

Just over 28,800 cattle were slaughtered at Department of Agriculture, Food and the Marine (DAFM)-approved factories in the week ending Sunday, June 22, which was almost 2,000 cattle below the same week of last year.

Prices have been in decline for the past four consecutive weeks but some processors halted their price cuts for the last full week of June.

With the peak volumes of grass cattle still over 10 weeks away, processors will be anxious to ensure adequate supplies over the coming two months.

| Category | Week ending June 22, 2025 | Equivalent Last Year | Cumulative 2025 | Cumulative 2024 |

|---|---|---|---|---|

| Young Bulls | 2,847 | 2,843 | 59,290 | 62,363 |

| Bulls | 569 | 671 | 12,270 | 13,453 |

| Steers | 9,864 | 9,996 | 308,115 | 296,255 |

| Cows | 7,147 | 9,050 | 190,230 | 206,849 |

| Heifers | 8,392 | 8,253 | 268,853 | 244,301 |

| Total | 28,819 | 30,813 | 838,758 | 823,221 |

Looking at the composition of the weekly kill, cow supplies have been running below last year to date with over 16,000 fewer cows slaughtered in 2025.

Heifer and steer kills have been strong this year to date but are expected to fall below the cumulative supplies from last year as this year progresses.

While prices have fallen since peak, there remains a large degree of optimism in the beef trade with prices remaining well above last year and trade forecasts continuing to look positive.