Sponsored Article

Sponsored Article

'Best succession plans encompass more than just tax'

Sponsored Article

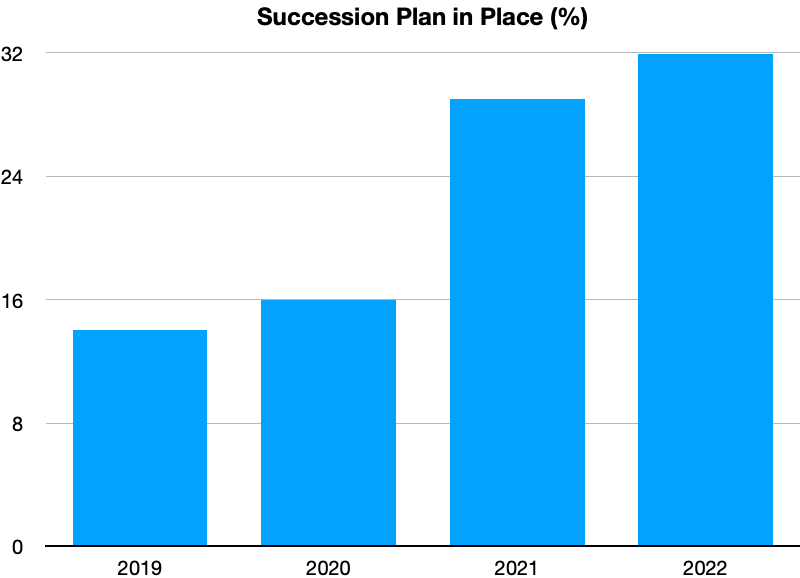

Proactive planning is on the rise and the best succession plans encompass a lot more than just tax, says Declan McEvoy in this year’s Ifac Irish Farm Report.

Farm succession generally has two key objectives: To secure the future of the farm and to provide sustainable income for both the retiring and the next generation.

The starting point in the planning process is identifying the expectations of all stakeholders who will be affected when the farm moves from one generation to the next.

Your stakeholders include not just family members but also your employees, your bank, and your business partners.

It’s important to remember that circumstances change and relationships can break down so your succession plan needs to be carefully thought through.

Key questions for the retiring generation to consider include:

To achieve a successful transition, you will need a willing and able successor and an agreed timeframe for succession. Where no suitable successor is available, alternative plans will need to be put in place.

Key questions to ask are:

You will need to compile a list of farm, plant, stock and land values, along with details of any current and/or planned future developments.

You will also need a list of each person’s assets as this will be required for tax planning purposes.

Viability

A farm that is not viable will not be able to support the retiring and incoming generation.

Take a hard look at your business. Ask your accountant to prepare financial projections and check that your business is structured appropriately. Take any necessary steps to improve profitability, including exploring off-farm income sources where appropriate.

Where viability difficulties exist, they can lead to family disputes. If this arises, it can be helpful to involve an independent professional with conflict-resolution skills.

It is important that your succession plan reflects relevant provisions in your Will and other legal documents.

Points to check include:

Your succession plan should include provision for unanticipated events, i.e. divorce, illness, accident, death or disaster. Insurance can help protect you against the financial impact of these risks. It is advisable to obtain independent financial advice when purchasing insurance, life cover and pension products.

Finally, remember your succession plan should include a dispute resolution mechanism.

Sponsored Article