CSO: Green diesel clearances 3% higher in first half of 2025

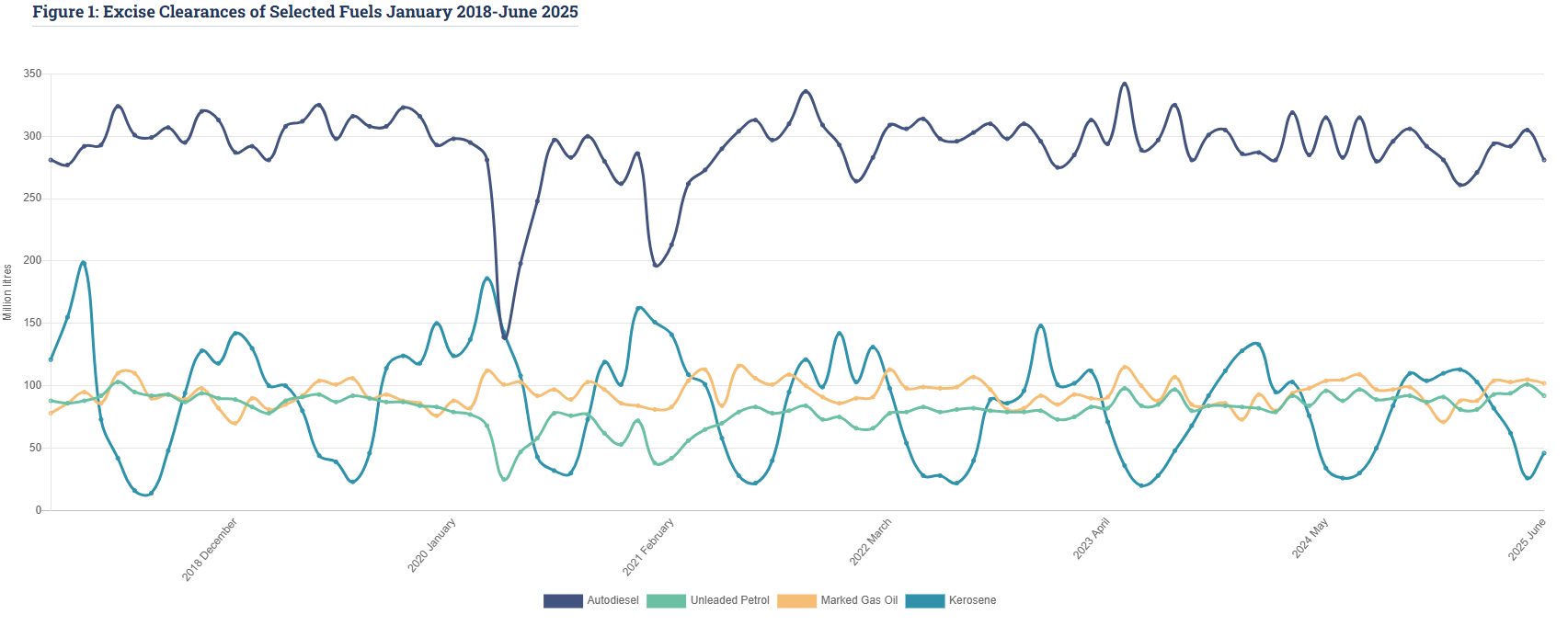

Clearances of marked gas oil, otherwise known as green diesel, were 3% higher in the first six months of 2025 compared to the same period in 2024.

That's according to the latest data publication by Central Statistics Office (CSO).

Excise clearances of marked gas oil in June 2025, at 102 million litres, were down 3% compared with the June 2024 figure of 105 million litres. Green diesel is primarily used for off-road purposes such as agriculture and the heating of larger buildings.

Other key findings in the report are that autodiesel clearances were 4% lower in the first six months of 2025 compared with the same period in 2024.

Unleaded petrol clearances were 4% higher in the first six months of 2025 compared with the same period in 2024.

Autodiesel clearances in June 2025 meanwhile, were 281 million litres; this was a 1% decrease compared with June 2024.

Excise clearances of unleaded petrol in June 2025, at 92 million litres, were 5% higher than the June 2024 figure of 88 million litres.

This was the highest volume of unleaded petrol clearances recorded for the month of June since 2018.

Commenting on the release, statistician in the Climate and Energy Division of CSO Ireland, Deirdre Moran said: "Autodiesel clearances were 3% lower when comparing the 12-month rolling period of July 2024-June 2025 with July 2023-June 2024.

"Clearances are the duty paid on the quantity of oil removed from bonded warehouses and provide a proxy for sales.

"Wholesale prices of autodiesel and unleaded petrol in June 2025 were lower than June 2024."

Kerosene clearances fell by 8% in the first six months of 2025 compared with the same period in 2024. Kerosene is mainly used as a home heating fuel.

Excise clearances of kerosene in June 2025, at 46 million litres, were up 74% compared with the June 2024 figure of 26 million litres. This was the highest volume of kerosene clearances recorded for the month of June since the time series began in 2000.

Excise duty on mineral oils is currently paid to the exchequer when the oils are removed from bonded warehouses.

Current excise rates (including carbon taxes) that are applicable at the end of the release month (or the rate that applied for most of the relevant month) are given in the table below in euro per thousand litres for the fuels most relevant for this release.

| Fuel | Rate per 1,000L |

|---|---|

| Autodiesel | €595.68 |

| Unleaded petrol | €688.78 |

| Marked gas oil (green diesel) | €219.50 |

| Kerosene | €160.81 |

| Auto LPG | €167.25 |

| Other LPG | €103.66 |

| Heavy fuel oil non-propellant | €210.45 |

| Heavy fuel oil for navigation | €595.68 |