Dairy farm incomes more than doubled in 2024 - report

Dairy farm incomes more than doubled in 2024, rising by 113% to an average of €108,189, a new report has revealed.

According to Teagasc's National Farm Survey, the recovery in dairy incomes in 2024 was driven by a strong recovery in milk prices and favourable grazing conditions from mid-year onwards, which boosted production later in the year.

Teagasc said: "In addition, input costs, such as feed and fertiliser, eased slightly relative to 2023, as did overhead costs.

"The strength of the income recovery is a reminder that Irish dairy farm incomes are highly sensitive to milk price movements in successive years, a factor over which dairy farmers have no control."

The National Farm Survey represents around 88,000 farms in Ireland, according to Teagasc. There were 15,131 dairy farms represented in the survey in 2024.

Teagasc said that a farm is deemed viable if family farm income (FFI) can cover family labour and provide a 5% return on non-land assets.

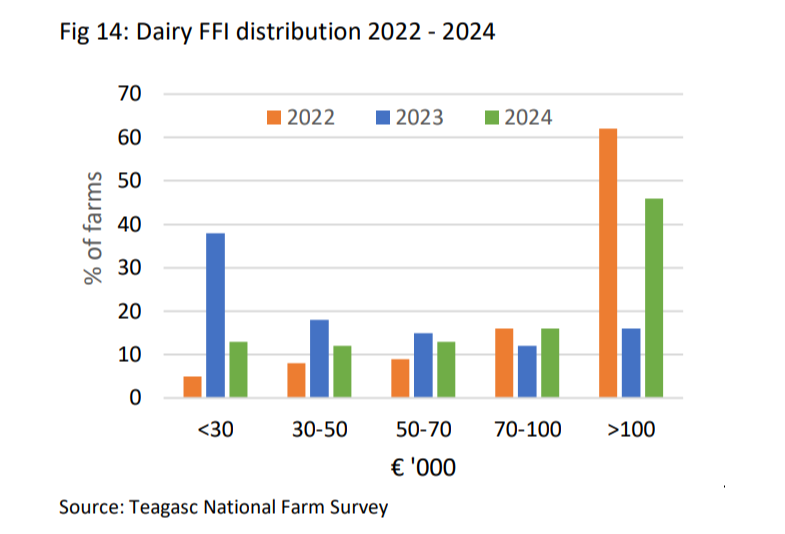

A large decrease in the proportion of dairy farms reporting an average FFI below €30,000 is apparent, dropping from 38% to 13% year-on-year.

The proportion of farms in the highest income category rose from 16% in 2023 to 46% in 2024.

In 2024, 12% of dairy farms reported an average FFI of between €30,000 and €50,000, with a further 13% earning between €50,000 and €70,000 and 16% reporting an average of between €70,000 and €100,000.

National Farm Survey results

Despite a decline in milk production in quarter one of 2024, compared to 2023, favourable weather conditions later in the year facilitated a recovery in production in quarter four, the Teagasc report outlines.

As a result, overall, milk production in Ireland declined only marginally by 0.4% in 2024 compared to 2023.

Gross output in 2024 typically increased by 15% relative to 2023 on dairy farms. This was due to the higher milk price, with a marginal decline in volume.

On a per hectare basis, average milk production decreased by 4% year-on-year to 11,210L.

Despite this, the improved milk price in 2024 resulted in an increase in gross output per hectare of 15% to €5,967 on average.

On a per hectare basis, direct costs decreased by 7% on average to €2,318.

Overall, this resulted in the average dairy gross margin per hectare increasing by 34% to €3,649 in 2024.

Dairy farm inputs

On the average dairy farm, total production costs declined by 4% year-on-year, with a reduction in both direct and overhead costs.

There was a significant decline in feed and fertiliser prices in 2024.

Purchased concentrate expenditure typically totalled €61,517 in 2024, a 5% decrease relative to 2023.

Expenditure on purchased bulky feed increased by 21% (to €8,861) on average in 2024, due to unfavourable weather conditions at times and possibly also to boost yields given the rising milk price over the course of the year.

Fertiliser expenditure on dairy farms decreased by 29% in 2024 to €17,820, on average. The volume of fertiliser use increased in 2024, Teagasc data shows, up 7% on average following a number of successive declines in preceding years.

On average, machinery hire - contracting - expenditure increased by 9% in 2024 to €19,938, with other livestock and veterinary costs remaining relatively unchanged at €17,509 following previous annual increases.

Overhead costs decreased by 5% on the average dairy farm in 2024, driven by lower building depreciation (down 23% to €11,403) and machinery depreciation (down 18% to €17,429).

Machinery operating costs remained relatively stable at €13,804.

Costs relating to hired labour increased, up 4% to €10,916.

There was also an increase in spending relating to land rental, with expenditure up 13% to €11,954, on average in 2024.

Almost eight in ten dairy farmers are renting in some land and that proportion has stabilised in recent years.

Milk quota removal

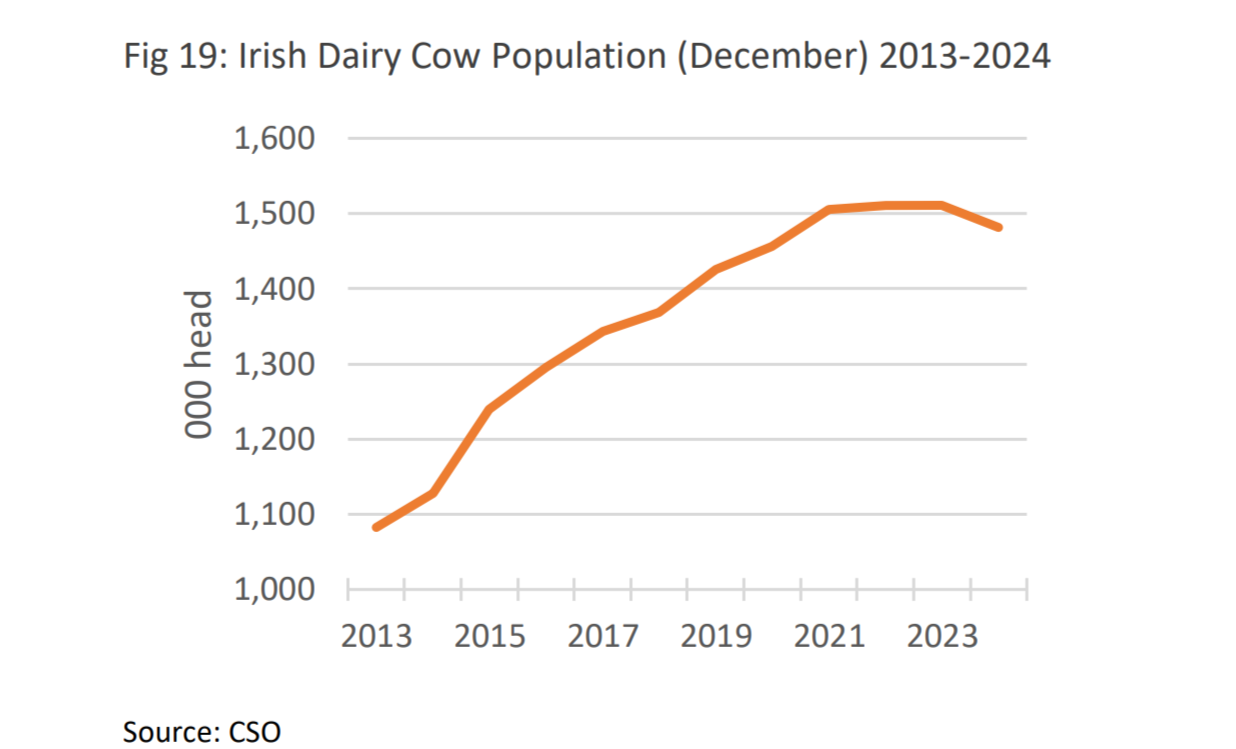

A decade has passed since the abolition of the EU milk quota system in April 2015 and in that time, the Irish dairy sector has undergone substantial change, Teagasc's report said.

Data from Teagasc and the Central Statistics Office (CSO) shows that while the number of dairy farms increased in the run up to the removal of the milk quota system, the number of dairy farms has actually declined slightly since then.

The dairy cow population increased from 1.13 million in 2014 to 1.51 in 2023, an increase of 33%.

However, recently there has been a slight decline, with the dairy cow population falling to 1.48 million in 2024.

"The number of dairy farms reflects the net change resulting from new entrants to the dairy sector, farms exiting the dairy sector and dairy farm consolidation," Teagasc said.

Compared to 2014, milk production in 2022 had increased by 56%.

Teagasc said that data shows farm incomes have become "increasingly volatile" over the last number of years.

"The volatility in milk prices over the last decade is very pronounced, with the annual average milk price in 2022 more than double the average annual milk price in 2016."