Dairy self-sufficiency growth in China to 'reshuffle' global trade - report

Growing self-sufficiency for dairy production in China will see a reshuffle for the global dairy trade, according to a new report from Rabobank.

The report shows that China increased its self-sufficiency in milk production by 11 million metric tons from 2018 to 2023.

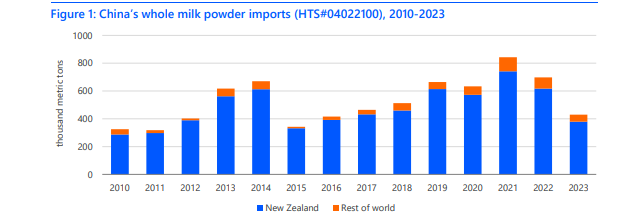

The country’s whole milk powder (WMP) imports plunged from an average of 670,000 metric tons between 2018 and 2022 to a mere 430,000 metric tons in 2023.

The report highlights that as China produces more dairy products domestically, New Zealand must seek alternative markets for its whole milk powder exports, leading to greater global dairy "export competition" and below-average milk powder prices.

New Zealand accounts for less than 3% of world cow milk production, but over 25% of global dairy trade.

Almost 1.3 million metric tons of milk – equivalent to 6% of New Zealand’s annual milk production – is now in search of import destinations in the form of WMP, skim milk powder (SMP), milkfat, and cheese, according to the report.

New Zealand’s WMP exports peaked in 2021 due to China’s robust demand, which dropped in the subsequent years.

In response, New Zealand adjusted its export strategy, increasing exports of SMP, butterfat, and cheese, offsetting a 255,000 metric ton fall in WMP exports between 2021 and 2023.

As part of an official visit to New Zealand recently, Premier Li Qiang visited the Fonterra Centre in Auckland accompanied by New Zealand Prime Minister, Christopher Luxon and other officials.

Speaking at the event, Fonterra’s CEO Miles Hurrell said Fonterra has built a strong relationship with its partners in China over the years.

“We have five Fonterra application centres in China, helping to develop new dairy products and supporting our customers adapt to market trends," Hurrell said.

The co-op will open its sixth application centre in Wuhan this year.

“Our application centres play a pivotal role in driving innovation and tailoring Fonterra’s Foodservice offerings to the tastes, culture and trends of the area in which they’re located,” Hurrell said.

Rabobank expects WMP imports in China to stabilise by 2025 near 500,000 metric tons, give or take about 50,000 metric tons.

Global strategist for dairy at Rabobank, Mary Ledman said: “If China’s demand falls, it triggers a chain reaction, causing each subsequent domino to topple.

"This has inevitably intensified competition among the existing dairy-exporting regions and led to lower-than-average global milk powder prices".

Ledman said it is "doubtful" China would become a net dairy exporter, but that it will cause a "significant challenge to the key dairy exporting regions".

While the cost of production will play a role in competitiveness, shorter supply chains and increased trade protectionism could potentially offset these costs.

"China’s increased self-sufficiency may serve as an example for other countries aiming to reduce reliance on trade," Ledman said.