Land report: Tax incentives boost popularity of long-term leasing

Long-term leasing is emerging as the preferred option for farmers due to tax incentives, increased stability, and supportive policy measures, according to a new report.

The Annual Agricultural Land Market Review and Outlook 2025 report, shows that the proportion of land under long-term leases remains at 74%, which is consistent since trend tracking began in 2017.

In contrast, conacre letting has experienced further decline, now registering a net decrease of 22% compared to 2023, "reinforcing its ongoing downward trajectory".

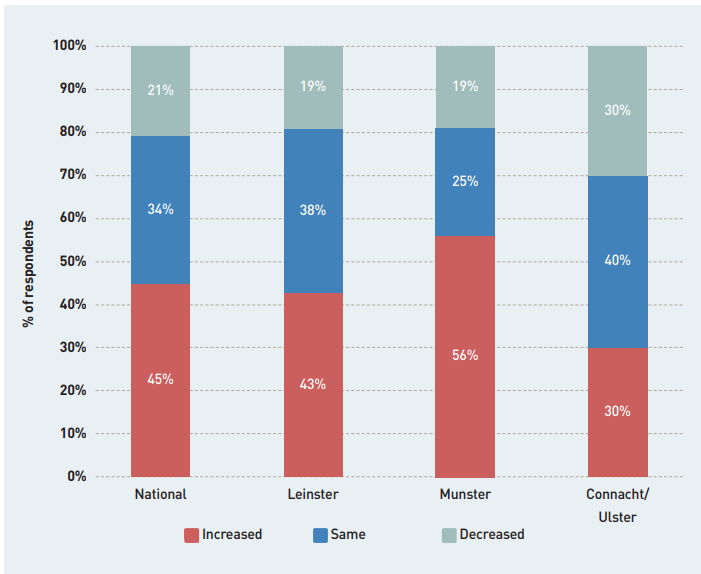

A total of 45% of Society of Chartered Surveyors Ireland (SCSI) auctioneers and valuers who took part in a survey for the report said that demand for long-term leases has increased.

34%of respondents reported that the level of land leased in 2024 in their region remained the same when compared to the levels reported in 2023.

The report, published by SCSI and Teagasc, found that Munster has experienced the most significant year-on-year increase in farmer demand for long-term leases, with 56% of respondents noting a rise, up from 40% in 2023.

The proportion of SCSI members reporting a decline has dropped to 19% from 30% last year.

"These findings suggest a continued shift toward secure, multi-year leasing arrangements," the report stated.

The report noted a decline in the percentage of respondents reporting an increase in lease durations, from 54% in 2023 to 46% in 2024.

It stated that this suggests "a growing stabilisation in the trend toward longer-term agreements".

The report said that the availability of land for leasing is largely influenced by two key groups: retired farmers or those who have lost interest in farming.

90% of respondents noted that this group remains somewhat or very active in leasing activity.

Nearly 43% of respondents indicated that a farmer who is continuing to farm but has decided to lease a portion of his farm is rarely or never active.

84% of respondents noted that farmers typically pay more per acre for similar quality land on a long-term basis, compared to short term lets.

Long-term leases are now increasingly favoured due to tax incentives and the stability they offer both landowners and tenants.

Since January 2024, tax relief earned on leasing farmland only applies to land owned for seven years.

The report found that rental values rose by 6% on average across all farming uses in 2024, driven by the limited supply in the land rental market.

One auctioneer in Munster said demand for rented ground was "very high" in their area, mainly down to the EU Nitrates Regulations.

"The European Commission decision regarding the renewal of the derogation later this year will be a deciding factor of how busier the rented land market will get and how high prices could go," they said.

The recent US tariff announcement and its possible implication on whiskey production was cited by another SCSI member as a significant factor that could impact on the demand for rented tillage land.