National Farm Survey: What did farmers invest in last year?

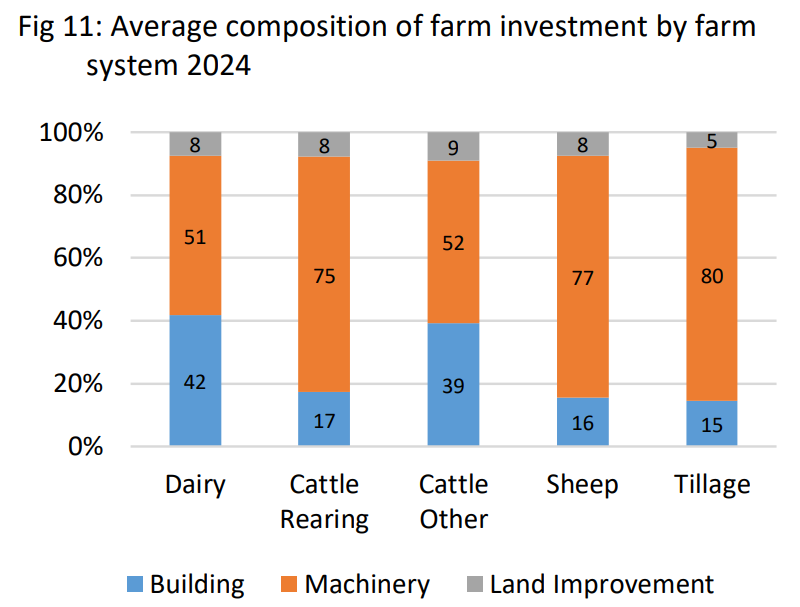

The latest Teagasc National Farm Survey (NFS) has revealed that machinery related investment was proportionately the largest investment category across farm systems in 2024.

According to Teagasc, it accounted for over half of total investment on the average dairy farm at close to €25,000, and 80% on the average tillage farm, at more than €18,000.

In aggregate, investment totalled over €1.33 billion in 2024 across the farms represented by the NFS.

Below is the average composition of farm investment by farm system in 2024:

The survey found that on drystock farms, machinery related investment represented three-quarters of total investment on cattle rearing and sheep farms, and half on cattle other farms in 2024.

In 2024, building investment averaged over €20,000 on dairy farms, with lower amounts reported across other systems.

The NFS also found that investment in land improvement was higher on dairy and tillage farms, when compared to drystock farms.

The data revealed that investment on dairy farms remained highest, with an average spend of €48,973 per farm in 2024.

Overall, investment on dairy farms accounted for about half of total farm investment identified in the NFS in 2024.

Investment on tillage increased by 9% year-on-year in 2024, while investment levels on drystock farms are on average lower, with investment spending of €9,168 on cattle other farms, €7,448 on cattle rearing, and €6,485 on sheep farms in 2024, all increasing year-on-year.

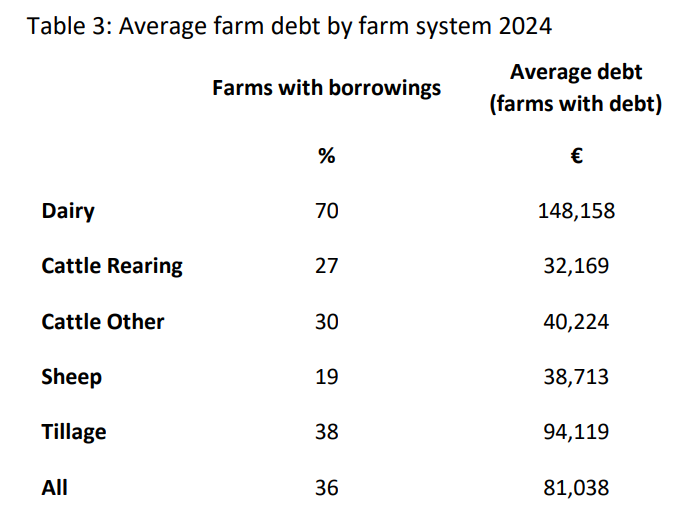

However, the NFS highlighted that despite an increase in investment, average farm related debt declined by 2% across all farm systems in 2024, when compared to 2023.

The data revealed that the average debt on dairy farms remains stable year-on-year, while debt on tillage farms was up 3% in 2024.

The average debt on cattle rearing farms was unchanged in 2024, with the comparable figure on cattle other farms down 10%, and farm related debt on sheep farms up by the same magnitude.

The table below outlines the average farm debt by system in 2024:

In total, 78% of farm related debt across all systems was classified as medium to long-term in 2024, with a further 17% relating to hired purchase or leasing, and the remaining 5% considered to be short term..

The NFS revealed that, on average, 83% of dairy farm debt was considered medium to long-term.

Meanwhile, 87% of debt on cattle rearing farms was considered medium to long term, with 75% considered medium to long-term on cattle other farms.

Teagasc revealed that the figure was lower, at 73%, on sheep farms, and 49% of average tillage farm debt was classified as medium to long term.