Rabobank: 'Demographic changes' to shape dairy consumption in China

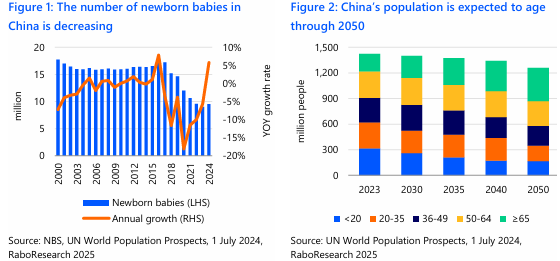

Significant "demographic shifts" in China - primarily because of a declining birth rate and increased life expectancy - will impact on future dairy consumption patterns in China, latest research suggests.

According to Rabobank the volume growth in "traditional revenue generating" categories like infant milk formula and liquid milk "is no longer sustainable".

It highlighted in its latest research report that over the last two decades Chinese consumers have tripled their dairy consumption.

But for the next decade current trends point to a slow down.

"In order to create and maintain value dairy companies should shift from basic dairy products to higher value added dairy products and ingredients and adjust their product portfolios to meet evolving consumer demands," the Rabobank reported outlined.

Although China's birth rate was up in 2024 the latest research suggests that this was because the Year of the Dragon was considered an "auspicious year for new borns".

"This increase is unlikely to hold in the long term as the number of females of childbearing age is declining and many Chinese couples think it is too expensive to have more children," Rabobank detailed.

In contrast however, the population aged 65 and older in China is set to increase by 186 million between 2023 and 2050 which is likely to translate into "more demand for dairy products with nutritional and functional benefits for immunity, gut health and mental health."

According to Rabobank this means that "innovation in adult milk powders, yoghurt and liquid milk are essential to cater to these needs".

The latest research also highlights that any growth in the infant milk formula market will come from "value rather than volume" .

It also suggests that the declining birth rate in China may see Chinese dairy players "explore opportunities" in other regions - particularly southeast Asia and also look to potential investment opportunities in new categories and sectors.