Report: EU pork trade relatively stable with higher supply forecast

Resilient demand and improved costs are sustaining the global pork trade despite an ongoing threat of risks, according to new research published by RaboResearch.

Lower feed costs and forecasted surges in pork consumption due to changes in seasonal demand trends will have a positive effect on the pork trade in the latter half of 2024.

Senior analyst for animal protein at RaboResearch, Chenjun Pan said: "Consumer demand for pork is relatively resilient across the globe, driven by a mixture of factors, including easing inflationary pressure, slower economic growth, competitively priced proteins, and seasonal changes.

“Earlier supply contraction and lower feed costs in most regions have improved farming profitability, along with productivity gains.

"Producers in some regions have started to rebuild sow herds, anticipating declining feed prices and growing demand.”

However, trade vulnerabilities caused by the volatile geopolitical landscape as well as the increasing spread of disease, remain potential risk factors.

European (including UK) pork production increased by 4% year-on-year between January and April 2024 on the back of negative production margins, however structural expansion is not expected, the report stated.

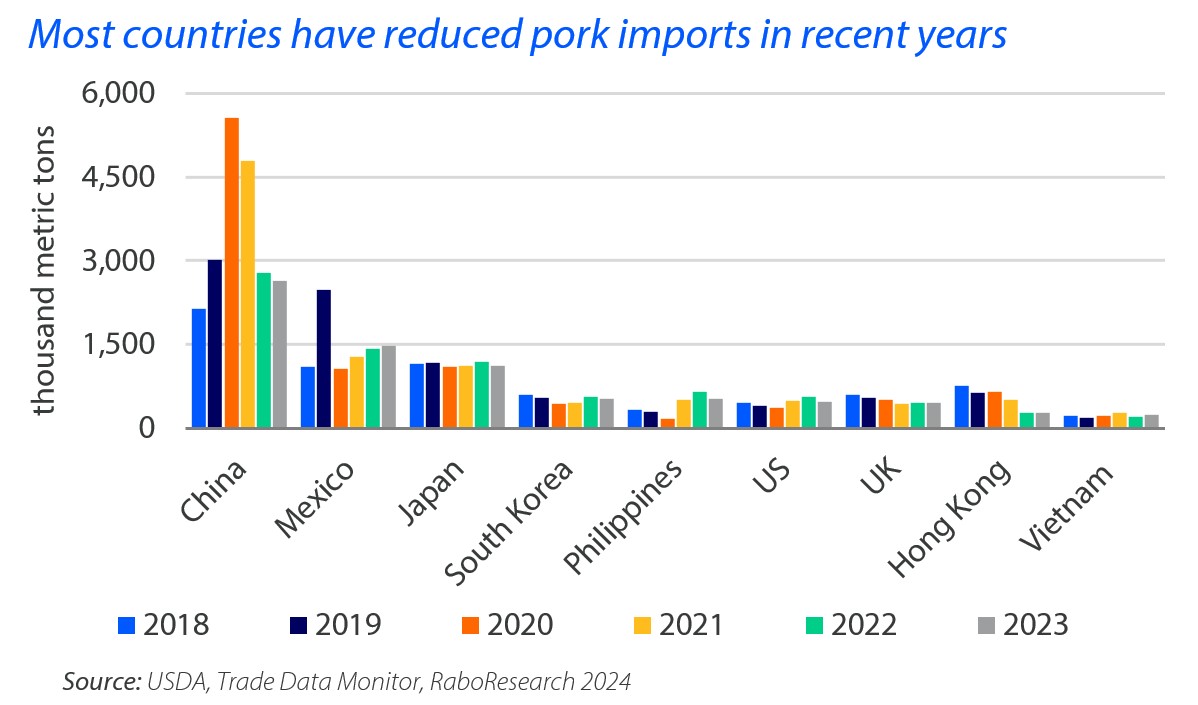

EU pork exports were down 7% year-on-year for the same period due to reduced demand from China and Japan, however, demand increased in other regions like Vietnam (+62%), the US (+30%) and South Korea (+19%) with continued growth expected.

The EU pork market has stabilised, with relatively little movement in pig prices in recent months.

The average price for a carcass was down 11% year-on-year in week 25 but this remains higher than the five-year average, with a slight further price drop expected due to marginally higher supply and waning seasonal piglet prices.

China remains the largest importer of pork globally, however, it launched an anti-dumping probe on EU pork imports in June to address its struggling indigenous sector, a measure which may inhibit the EU and global pork market as a result.

“A suspension of EU exports or high tariffs could mean global pork trade flows are rerouted as China finds new origins and EU exports flow to other regions,” Pan continued.

“If EU exporters offer discounts to capture new markets, importing countries may need to support and protect local producers.

"Meanwhile, other exporting countries may find their traditional trade partners shift to cheaper EU pork products.”

The US-China trade war that started in 2018 has already altered the global market with the US losing its competitive advantage to China, due to the influx of higher tariffs.

Brazil was the largest beneficiary of such events, with a record-breaking 1.229 million tonnes of pork sold last year alone (12.3% of the export market), as evidenced by data from the Brazilian Animal Protein Association.

The results of the upcoming US presidential elections could see further havoc to global trade patterns, according to RaboResearch.

“With rising concerns over trade disruptions given these geopolitical complexities, many governments have supported improvements in domestic production to increase self-sufficiency and reduce reliance on imports,” Pan added.

The continuing outbreak of disease, namely African swine fever, in certain countries like China, Vietnam, the Philippines and most recently Germany, will reduce export supply emanating from these markets as biosecurity concerns persist.

The research indicates then that producers are therefore hesitant to invest in sow replenishment as effective preventive measures and solutions to the growing incidence remain wanting.

Other markets, including the US and EU will likely experience increased production rates on the back of this, concludes the report.