Report: Glanbia paid dividends of €27.8m to Tirlán during 2024

Nutrition company, Glanbia, paid dividends of €27.8 million during 2024 to Tirlán Co-operative Society and its subsidiaries, based on their shareholding in the company, its latest annual report highlights.

Tirlán held 75,537,305 ordinary shares in Glanbia - which represented 29.2% of the issued share capital of the company - at January 4, 2025.

In Glanbia's annual report and financial statements for 2024, it also details that shareholders - who are on the register of members on March 21, 2025 - are set to receive a dividend of €0.23 per share on Friday, May 2 this year.

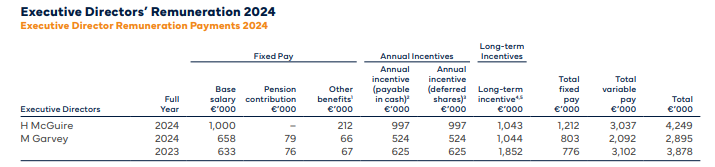

The latest set of financial statements also sets out details of the salaries and overall renumeration packages that Glanbia's top management team received last year.

It shows that its chief executive officer (CEO), Hugh McGuire, was hired on a basic salary of€1 million and that his total renumeration package for 2024 totaled over €4.2 million. McGuire has been in the role since January 1, 2024.

Meanwhile Glanbia's chief financial officer (CFO), Mark Garvey, renumeration package was in the region of more than €2.8 million.

Both the group CEO and the group CFO have a rolling 12 month notice period.

Separately Glanbia's chair, Donard Gaynor, confirmed that after almost twelve years with the group and over four years as group chair, he intends to retire from the role and step down from the board of Glanbia at the end of the 2026 AGM.

According to Glanbia it "outperformed on all our mid-term group financial targets in 2024" and Optimum Nutrition brand "had a strong year, delivering 7.5% revenue growth constant currency".

It also highlighted in its latest annual report that Optimum Nutrition is "sold in over 100 countries and with annual revenue well in excess of $1 billion".

But according to Hugh McGuire, Glanbia will have to manage "unprecedented whey protein market dynamics" in 2025 which it expects to be "transitory".

The group also cautioned in its 2024 annual report that "economic vulnerabilities remain in 2025".

One key risk identified is the "introduction of tariffs between the US and some of its key trading partners".

The group also noted that "unpredictable climate conditions, which may drive prices higher" is another potential risk for Glanbia.

Meanwhile looking ahead its CFO said "Glanbia has commenced a group-wide transformation programme to drive efficiencies across the group’s new operating model".

"The new operating model is designed to further simplify the business, increase focus on high-growth end-use markets, and provide greater insight into Glanbia’s value drivers and growth opportunities," Mark Garvey added.