Research: US tariffs on EU exports would hit agri sector

The potential imposition of 25% US tariffs on EU exports threatens to disrupt food and agriculture trade flows significantly, according to the latest research from Rabobank.

With the EU having a substantial trade surplus with the US, these tariffs could impact multiple food and agricultural sectors, particularly agricultural machinery and processed consumer foods, according to a RaboResearch report.

Companies are urged to prepare for possible changes by considering strategic responses.

Tariffs could alter trade dynamics not only between the US and EU but also globally, shaking up trade flows with other countries, the report indicated.

RaboResearch stated that the EU is largely self-sufficient in agricultural products, exporting relatively small surpluses globally, with a significant portion destined for the US.

However, the EU relies heavily on imports for soy and soy products, primarily sourced from the US and Brazil.

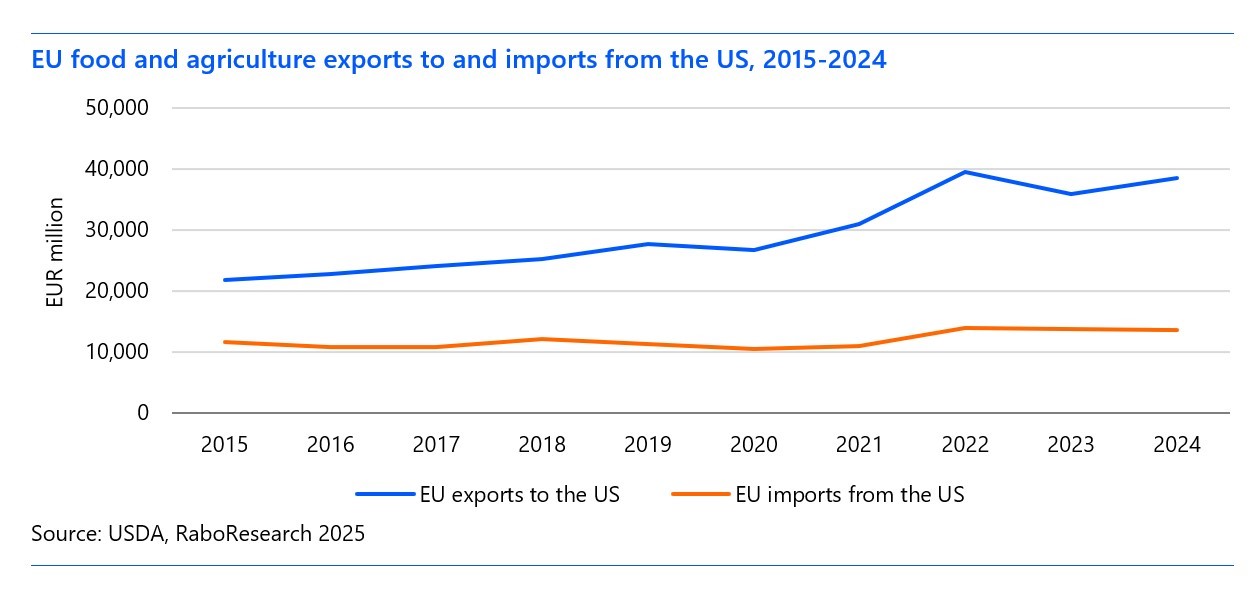

The EU enjoys a substantial trade surplus with the US in food and agriculture, exporting €38 billion worth of products in 2024, compared to €14 billion in imports from the US.

This surplus is driven by the export of high-value products like essential oils, wine, olive oil, and dairy, while the US exports lower-value commodities.

Senior specialist, food and agriculture for RaboResearch, Barend Bekamp said: “From the EU’s point of view, the US is a major trade partner, mainly serving as an important export market rather than a supplier.

"From the US perspective, the EU is more significant as a supplier than as an export destination.

"The US market is more crucial to EU food and agriculture companies than the EU market is to US companies."

The sectors most vulnerable to US tariffs are those with a significant US market share and high price elasticity of demand.

RaboResearch’s assessment indicates:

- High impact: The agricultural machinery sector is expected to be hit the hardest due to the strong US machinery industry offering alternatives. US farmers, facing tight margins, may opt for domestic products over EU imports subject to tariffs;

- Medium impact: Processed consumer food products, including beverages, pasta, and dairy, might experience a medium impact. The variation in impact depends on the price elasticity of demand within these sectors;

- Low impact: Sectors like animal protein, fertilisers, and sugar, where the US is not a major market, are likely to see minimal impact. Products with low price elasticity can absorb tariff costs through higher prices.

“In response to potential tariffs, EU companies can consider several strategies,” Bekamp continued.

Options include: Maintaining prices and shifting costs to US importers; reducing prices to remain competitive; withdrawing from the US market; redesigning supply chains to bypass tariffs; or investing in US-based production.

The best option for a given company depends on a number of factors, including the price demand elasticity of its products and its international footprint.

“Tariffs threaten not only the trade relationship between the EU and the US. Canada, Mexico, and Brazil also face US-imposed tariffs and are likely to retaliate," Bekamp said.

"This could result in a complex web of regional and sectoral interactions that significantly transform global trade dynamics.”

The EU is a €200 billion exporter of food and agriculture products, with the US being its second largest export partner.

According to RaboResearch, US President Donald Trump’s potential tariffs on EU food and agriculture exports to the US could seriously impact EU companies.

If the EU imposes tariffs on food and agriculture imports from the US, it would significantly affect buyers and processors of US commodities, including EU dairy, pork, and poultry farmers.