Sunshine boosted sales of sausages and ice cream in May - Kantar

A burst of sunshine and warm weather encouraged shoppers to spend an extra €73 million on groceries, including sausages and ice-cream, last month according to the latest research released today (Tuesday, June 3) from Kantar.

Grocery price inflation currently stands at 4.96% compared to the same 12-week period last year while inflation has increased 2.4 percentage points since the same time last year.

According to Emer Healy, business development director at Kantar, when inflation goes above 3% to 4% this is when shoppers "really start to feel it in their wallets, and they change their behaviour".

Latest analysis from Kantar shows that take-home value sales in Ireland over the four weeks to May 18 increased by 6.6% compared to the same period last year.

Last month shoppers also went to stores an average of 22.3 times which in turn contributed an additional €17 million to the overall spend on products.

However over the latest 12-week period under review, shoppers bought their groceries more often online - up by 10.4% - spending a total €20.3 million.

According to Healy, the warm and sunny start to May encouraged many people to fire up the BBQ and dine alfresco for the first time this year.

She added: "Shoppers spent an additional €14 million on typical summer fare, including sausages, coleslaw, antipasti, potato salad, non-alcoholic drinks, fabs and mixers, pickles, beer and cider and ice cream.

"With shoppers taking full advantage of the sunshine, we saw an additional €50,000 spent on suncare compared to this time last year.”

The latest research from Kantar also shows that shoppers spent an additional €124 million on promotional lines over the last 12 weeks under review compared to the same period last year.

It found that the total promotional market grew by 17.6% but there was double digit growth in particular items, including table sauces, skin care, deodorant, soft drinks, frozen confectionery, and chocolate.

According to Kantar, brands still hold a higher value share of the total market in Ireland at 47.4%, compared to own label with 47.1% value share.

It found there had been double digit growth (+12.6%) over the recent 12-week period, premium own label continues to grow faster than the market as a whole (+6.1%).

Premium own label currently holds 4.1% value share of the total market compared to 3.9% last year.

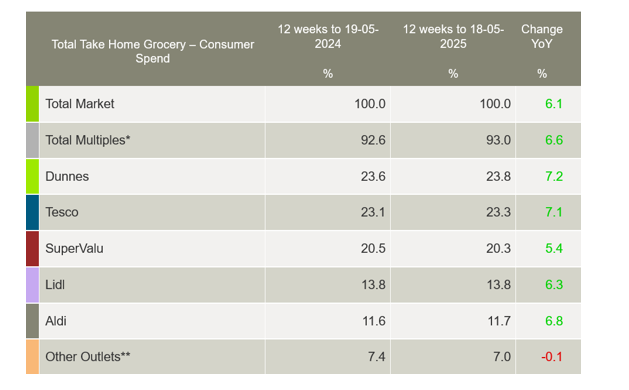

Meanwhile Kantar's analysis of the latest 12-week period found that Dunnes holds 23.8% market share, with sales growth of 7.2% year-on-year.

Tesco holds 23.3% of the market, with value growth of 7.1% year-on-year while SuperValu holds 20.3% of the market with growth of 5.4%.

Next on the list was Lidl, which holds 13.8% market share up 6.3% while Aldi holds 11.7% market share, up 6.8%.