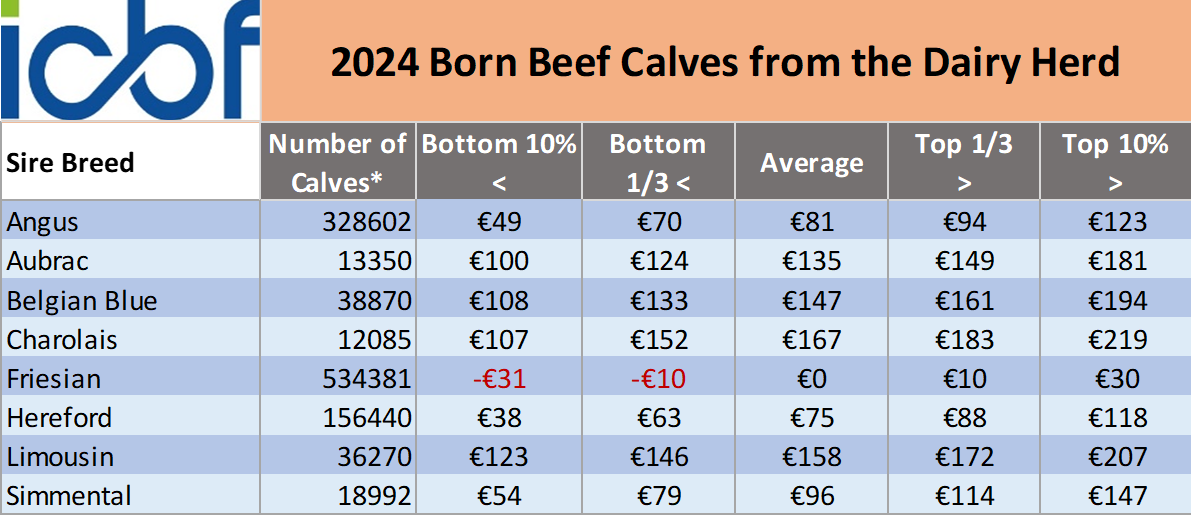

Table: What can dairy-beef farmers afford to pay for calves?

The uplift in factory beef prices seen in recent weeks is filtering down into the prices being paid by farmers for lighter types of store cattle and the number of calves being traded is starting to increase.

The vast majority of calves will be traded in the coming three months.

There is lots of speculation on how average calf prices will fare out this year with many dairy farmers expecting a significant uplift in the prices received for calves.

Teagasc's DairyBeef500 programme manager Alan Dillon has warned that "a moderate increase in [calf purchase] prices on a farm with a high stocking rate can erode profitability in the system fast, especially if beef prices were to be lower rather than higher in two years’ time".

In a recent post on the Teagasc website, the Teagasc advisor acknowledged that the initial buying cost of the calf is not the biggest part of the investment in a calf-to-beef system.

He said: "Typically, Friesian bulls were costing around €70 early on last year, while early maturing bulls were costing around €200.

"Recent Profit Monitor results for DairyBeef 500 demonstration farms showed the cost of taking a calf through to finish is around €1,330, which excludes farmers' own labour and an owned land charge."

Dillon said that these costs would be "at the lower-end of the scale given these monitor farmers are implementing the best technologies and have a very good handle on costs".

To put this in context, when calf purchase price is counted in, a Friesian steer would need to make almost €1,400 to break even, while an early-maturing steer needs to make €1,530 at a minimum to cover its costs.

The DairyBeef 500 demonstration farms averaged 306kg of carcass at 24 months for steers finished in 2024.

The average beef price in 2024 was €5.07/kg, which Dillon acknowledged was "a record price for Irish beef farming we have never seen before over a 12-month period".

He cautioned that "although prices are better now, we don’t know where prices will be in 2027".

The table below outlines the prospective margins on DairyBeef 500 farms at various calf and carcass prices:

| Calf price | Grade | Cost to 24 months | Base price | Carcass weight (kg) | Carcass return (€) | Profit/head (excluding land and labour charge) |

|---|---|---|---|---|---|---|

| Friesian bull €70 | P+ | €1,330 | €5.07 | 306 | 1,459 | €59 |

| Friesian bull €100 | P+ | €1,330 | €5.07 | 306 | 1,459 | €29 |

| Friesian bull €150 | P+ | €1,330 | €5.07 | 306 | 1,459 | -€21 |

| Angus bull €150 | O= | €1,330 | €5.07 | 306 | 1,618 | €138 |

| Angus bull €200 | O= | €1,330 | €5.07 | 306 | 1,618 | €88 |

| Angus bull €250 | O= | €1,330 | €5.07 | 306 | 1,618 | €38 |

| Angus bull €300 | O= | €1,330 | €5.07 | 306 | 1,618 | -€12 |

Commenting on the data in the table, the DairyBeef 500 programme manager said: "What can be seen from the above calculations is that even with high levels of efficiency, the dairy calf to beef game is a very tight margin business.

"Granted, beef prices are higher now, but it is obvious that if beef prices were to replicate 2024 in two years’ time, any high calf prices will lead to loss-making territory.

"What the figures show is even efficient producers could be in danger of losing on every head if Friesian prices go over €100 and Angus/Herefords hit over €250."

The wider rollout of the commercial beef value (CBV) will assist beef famers in purchasing calves and identify which calves are worth more or less than one and another.

The table below details poor, average and good CBVs for dairy-beef calves based on the 2024 breed percentiles:

While the higher CBV calves will have better genetic potential to deliver a higher beef yield, Dillon acknowledged that "every calf will need to find a home".

He said: "No one should be expected to work for a loss and the dairy industry may be in need of calf buyers next year once the Dutch export market closes its doors to 80,000 Irish calves."

For calf sellers and buyers, the calf-to-beef advisor believes that "the most important thing is the [trading] relationship is maintained and this means setting reasonable prices on both sides for calf sales".

"Dairy farmers need to be cognisant of the fact that for every 10 farmers that walk into their yard or mart ring to buy calves, only four will be still buying in five years’ time.

"It is a huge dropout rate and highlights the important service calf-to-beef farmers provide to the dairy industry. If margins are improved in the business, calves will be easier to sell in bad years once the calf buyer is not burnt.

"The end price of dairy beef cattle is what is making the headlines in the dairy farmer’s mind, but the costs incurred in getting there and the skill set required to get to that stage and profitably is often glossed over. The calf-to-beef farmer is an important asset to the Irish agricultural industry and they need to be maintained," Dillon concluded.