CSO: Tractor registrations show 9.1% drop this year

The general trend in declining tractor sales is not confined to Ireland, where figures from the Central Statistics Office (CSO) show a 9.1% drop in registrations in 2024 so far, compared with last year.

In the Unites States, the situation is even less comfortable, with a 13.6% reduction in total tractor sales, while Canada has suffered a 17.4% drop according to the Association of Equipment Manufacturers (AEM).

In both these markets it is the 100hp+ tractors that have shown the greatest resilience, while in Ireland the most popular power band has now risen to the 141 to 160hp segment, according to the FTMTA.

Vital metric

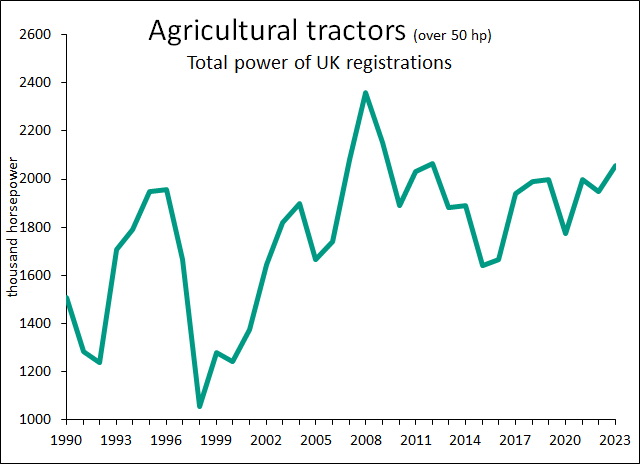

Neither has the UK fared well with a 13.1% decline in the year to date. However, there is a further metric available from the Agricultural Engineers Association (AEA) which paints a slightly less pessimistic picture, and that is the total power of UK registrations.

It is this figure which is a true reflection of the state of the tractor market for, unlike the headline grabbing number of units sold, it actually indicates the demand for mechanical power that is out there.

By using this perspective a different story emerges, and that is one of more power being purchased to farm what is a slowly decreasing area of land.

In 1990, the figure stood at around seven million hectares and the total power of the tractors registered was 1.5 million hp, or 4.6 ha/hp sold.

33 years later, the total amount of hp registered in the UK in 2023 was two million, and the land under cultivation 6.2 million hectares, bringing it down to one hp for every 3.2ha being farmed.

Sales headwinds

Unfortunately, similar figures for America, Canada and Ireland are not immediately available, but the CSO records a trend for Irish land to be switched from agriculture to forestry and residential with energy capture also taking ground out of farming.

We therefore have the perfect storm for manufacturers and dealers. Less land being farmed and bigger tractors being sold can only mean a reduction in the number of units being purchased, and this indeed has been the trend over the decades.

Yet manufacturers continue to make healthy profits, while it is the dealers who are suffering with closures and mergers occurring frequently as sales volumes decline.

New markets

Given these trends, there can be little surprise in seeing the big corporations seeking a more streamlined distribution system, despite such action denying customers the width of choice and personal attention they presently enjoy.

It also goes a long way to explain why they are so focused on exploring alternative markets such as Brazil, a country that both AGCO and CNH have indicated is of growing importance to them.

A further affect that this may well be having, is that with a fewer number of tractors passing down the production line the price of each will have to rise if the factories are to be kept open.