Weather affects value of prime grassland at start of 2025

While the weighted average price of prime grassland rose to €13,786/ac in quarter one 2025, the 4.7% growth recorded represented approximately half the 9.3% increase seen for the same period the previous year.

That's according to Sherry Fitzgerald which has just published its Agricultural Land Market Review Q1 2025 today (Thursday, June 19).

The reduced growth, despite favourably high milk and beef prices and lower fertiliser prices, can be largely attributable to poor weather conditions and uncertainty surrounding the nitrates directive and Mercosur trade deal.

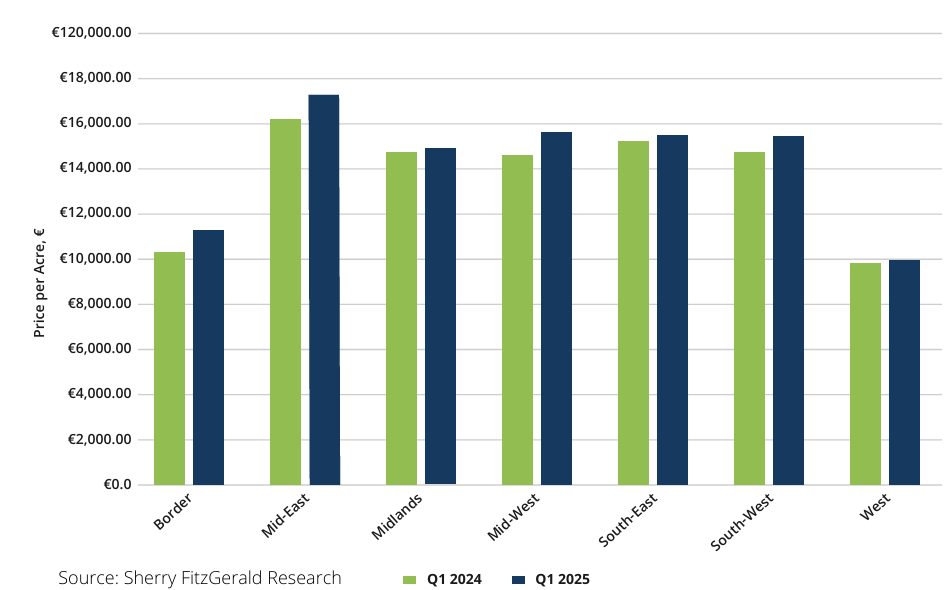

All regions saw growth in prime grassland values during the 12 months to quarter one 2025. The Border region had the largest increase at 9.7%, bringing the average value to €11,333/ac.

Prices in the mid-east, the most expensive region with average values at €17,313/ac, grew by 6.4%, while the mid-west, with the second highest average value at €15,667/ac, experienced the second fastest growth at 7%.

With an increase of just 0.8%, the midlands experienced the smallest rise, bringing its average value to €14,875/ac.

Marginal grassland values witnessed the sharpest slowdown in growth. Following a 9.2% increase in 2023, average values increased by 4% in 2024.

This trend continued into early 2025, with values increasing by 1% between quarter one 2024 and the opening quarter of 2025.

This is significantly lower than the 11.3% rise in the corresponding period a year earlier. The weighted average price in quarter one 2025 was €8,015/ac.

While the strong growth in 2023 was primarily driven by farmers acquiring land for new nitrate regulations, the same headwinds affecting prime grassland, including uncertainty about the nitrates derogation extension, have contributed towards slower price growth for marginal grassland.

Marginal grassland values in the mid-west grew the most at an annual rate of 9.8%, reaching €9,333/ac.

The mid-east had the highest average price per acre at €10,625 following a 1.3% rise in the year, while the west continued to see the lowest price per acre at €5,100 following no change during the 12-month period.

The midlands region experienced the largest annual drop in value, decreasing by 10.2% to an average of €9,000/ac.

This was followed by the south-west, which saw a 1.3% drop, bringing its average value to€8,256/ac.

According to the report, several obstacles lie ahead for the agricultural industry in Ireland in 2025.

Sherry Fitzgerald has stated that Ireland’s dairy and tillage sectors "stand dangerously exposed" to US President Donald Trump’s tariffs, given the significant volumes of butter and whiskey shipped to the US.

Ibec estimates that a staggering 46% of spirits exported, including whiskey, and 21.3% of Irish dairy exports are destined for the US, highlighting the potential impact of tariffs on these industries.

While the US and EU have now paused reciprocal tariffs for 90 days, a 10% tariff on all EU exports to the US remains in place in the interim.

Trump has also threatened to impose a 50% tariff on the EU to begin in July if the EU and US fail to come to a trade agreement.

The EU’s initial plan for reciprocal tariffs included tariffs on various industries. However, they excluded bourbon and dairy following lobbying from several nations, including Ireland, aiming to safeguard their significant drink and dairy industries.

The Mercosur deal is a trade agreement between the EU and a trading bloc in South America comprising the countries of Brazil, Argentina, Paraguay and Uruguay.

This agreement will remove barriers to trade such as tariffs, which will increase trade between the two areas.

This agreement is now more likely due to the trade disruptions caused by Trump and it presents a significant threat to Irish farmers, according to Sherry Fitzgerald.

Irish farmers fear being undercut on beef and other produce due to South American countries’ less stringent regulations.

Several EU countries are shifting their stance towards a deal as they search for alternative markets to trade with. The deal will now have to be ratified by the EU with a vote expected to happen later this year.

A crucial decision regarding the extension of Ireland’s nitrates derogation is also on the horizon.

If this derogation is not renewed, Irish farmers will face the challenge of adhering to stricter stocking rate limits to a maximum of 170kg N/ha.

One likely consequence is the need for farmers to acquire additional land to avoid breaching these new limits.

Key lending rates are now close to half that seen a year ago. Downside risks to economic growth in the Euro area persist amid continued uncertainty surrounding US tariffs.

Although rates are likely to remain unchanged in July, a further cut is expected later in the year.

Even with the current 90-day pause on reciprocal tariffs, the existing 10% tariff remains asignificant challenge for businesses to navigate, the report outlined.