Beef kill: Weekly supplies over 40,000 failing to fill demand

Weekly beef kill figures surpassed 40,000 head in the week ending Sunday, October 6, and while this would be considered a large weekly kill of cattle, market indications suggest supplies are still failing to satisfy demand.

UK beef prices have rallied in late September and into October with the average UK R3 steer price now over €1.00/kg above the Irish steer price while the Irish beef price has remained more steady albeit at a good base level above the €5.00/kg mark.

Reports from Irish factory agents for the trading week ending Friday, October 11, indicate prime cattle prices have moved up by as much as 10c/kg in some cases this week.

Some outlets are delivering price increases through breed bonuses for cattle meeting the specifications their customers requite while other outlets are delivering price rises to farmers through a rise in their base price offerings.

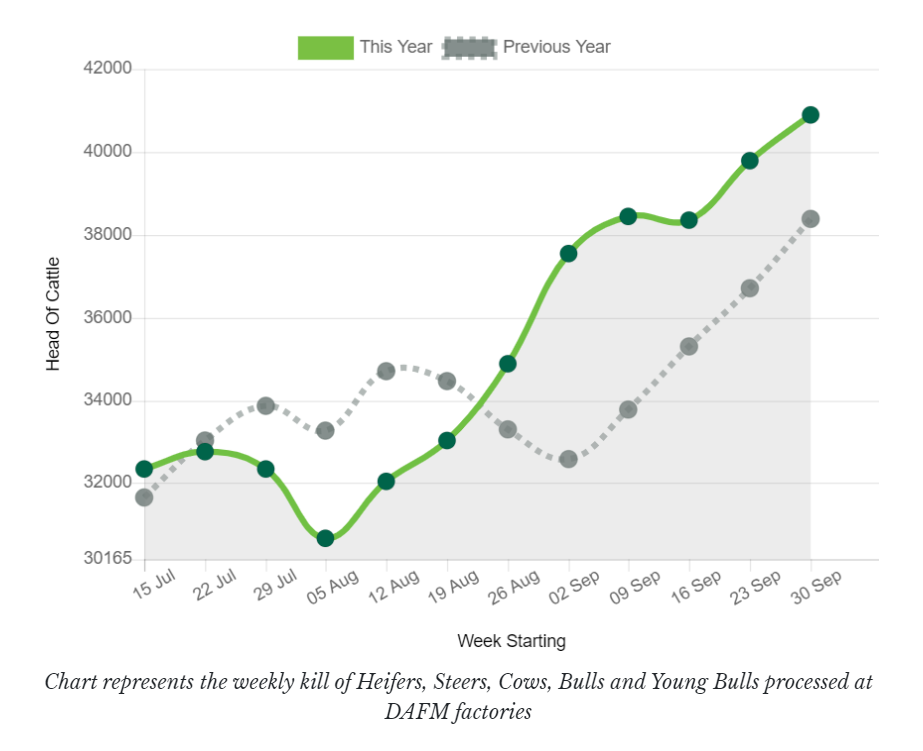

The graph below shows the rise in the total beef kill over the past eight weeks and also shows how supplies are trending ahead of last year:

Over 46% of the cattle supply last week was bullocks (steers) at just under 19,200 head with heifers accounting for just under 28% of the kill at 11,350 head.

High weekly cow kills are continuing with just under 8,800 cows slaughtered last week bringing the total cow kill this year to just over 330,000 head.

The table below details the beef kill composition for the week ending Sunday, October 6 versus the same week of last year and the cumulative beef kill this year versus last year:

| Type | Week ending Sun, Oct 6 | Equivalent Last Year | Cumulative 2024 | Cumulative 2023 |

|---|---|---|---|---|

| Young Bulls | 1,085 | 1,228 | 84,589 | 91,813 |

| Bulls | 491 | 474 | 23,082 | 22,293 |

| Steers | 19,172 | 17,856 | 519,230 | 526,757 |

| Cows | 8,795 | 8,911 | 330,150 | 298,173 |

| Heifers | 11,354 | 9,924 | 386,033 | 371,609 |

| Total | 40,897 | 38,393 | 1,343,084 | 1,310,645 |

The total beef kill to date this year is just over 1.34 million cattle which is just over 32,400 head above last year.

Looking closer at the kill figures to date this year, the cow category has attributed to the greatest rise in the overall kill numbers growing by almost 32,000 head.

Prime cattle supplies are forecasted to tighten in the final quarter of this year and into early next year and with market demand remaining strong, signals would indicate further positivity in the beef trade could well be expected.